Bioenergy Project Financing: Funding Your Bioenergy Project

24 Oct 2023

The agricultural industry has not always been associated with renewable energy. However, it does have a unique opportunity to make a profit and play a crucial role in the production of renewable energy.

With an abundance of biomass on farms, farmers can leverage their resources to create bioenergy projects. These projects give rise to both environmental benefits as well as economic stability. An example of this is the Italian renewable energy landscape.

Yet, financing bioenergy projects can be a significant challenge for farmers or other landowners. Both may not have the same access to traditional financing options as larger corporations.

This guide will provide practical advice for anyone looking to start or develop a bioenergy project. Specifically, how to navigate the funding landscape. Whether you are a land owner or developer, this guide will inform you of important considerations to bring your bioenergy project to life.

Benefits of Developing a Bioenergy Project

The main benefit for farmers of developing a bioenergy project is that you are turning a profit from waste. Who doesn't want a project produces revenue without additional costs? Note this isn't without upfront costs. For example, the purchasing of required machinery and, if applicable, potential developer-associated fees.

Financial benefits can be realised in many ways that we look at below.

Reduction in Energy Costs

Firstly, as the project owner, you could choose to use part or all of the energy yourself. Energy could be heat, electricity, gas or fuel produced locally to give the owner a reduced energy bill.

This could be a helpful indirect advantage for your home and farm beyond the additional options for profits discussed below.

Sale of Energy

The bulk of the revenue will come from the sale of the energy produced. However, extra steps may be necessary to convert the heat or gas produced into usable power for energy providers. Typical usable forms include fuel or biogas that can be sold directly to energy providers.

Many governments offer incentives to help support the construction of bioenergy projects. These incentives further increase profits in production. For example, the UK government has a Green Gas Support Scheme. This programme invites biomethane producers to apply for quarterly payments (based on their production) for up to 15 years.

Sale of Carbon

Furthermore, there is also the potential of generating a profit from carbon capture technologies. Bioenergy production is considered a carbon-neutral process. Significantly, correct implementation of carbon capture utilisation (CCU) technologies could make it carbon-negative.

In both 2021 and 2022, the UK experienced carbon dioxide shortages which led to problems in the food and drink industry. Carbon dioxide is made via both biomass combustion and anaerobic respiration. Thus, the incorporation of CCU technologies could be another source of revenue in bioenergy projects.

Sale of Project

Lastly, profit could be generated by selling this project to a larger developer. Starting a bioenergy project is quite complex. The easiest route for a farmer with available land and a large and constant supply of feedstock may be to sell. Sale of this renewable energy project would be to an experienced developer in exchange for a share of the profits generated.

Different Types of Bioenergy Projects

It's important to understand that there are different types of bioenergy projects available to farmers. After we will delve into funding options for your bioenergy project.

There are a few options to choose from, each suited to the production of different renewable energy forms (heat, gas, fuel). Depending on your goals, each carries its own unique advantages and considerations.

Biomass combustion

Biomass combustion is the more “traditional” form of energy production. This method has been used by humans since the beginning of time to produce heat - think wood fireplaces and firepits.

Most commonly, biomass combustion will use wood (or by-products such as bark or sawdust) because of its dryness. Plant materials may sometimes be used, but are generally too wet and thus better suited for other forms of bioenergy production. Additionally, processes such as gasification and pyrolysis can use combustion to produce syngas.

This technique is still used today to create heat for homes and other smaller buildings. Technology advancements have enabled to also generate electricity via steam turbines.

Anaerobic Digestion

For anyone with a large amount of feedstock and agricultural waste, anaerobic digestion is a viable option to turn an extra profit.

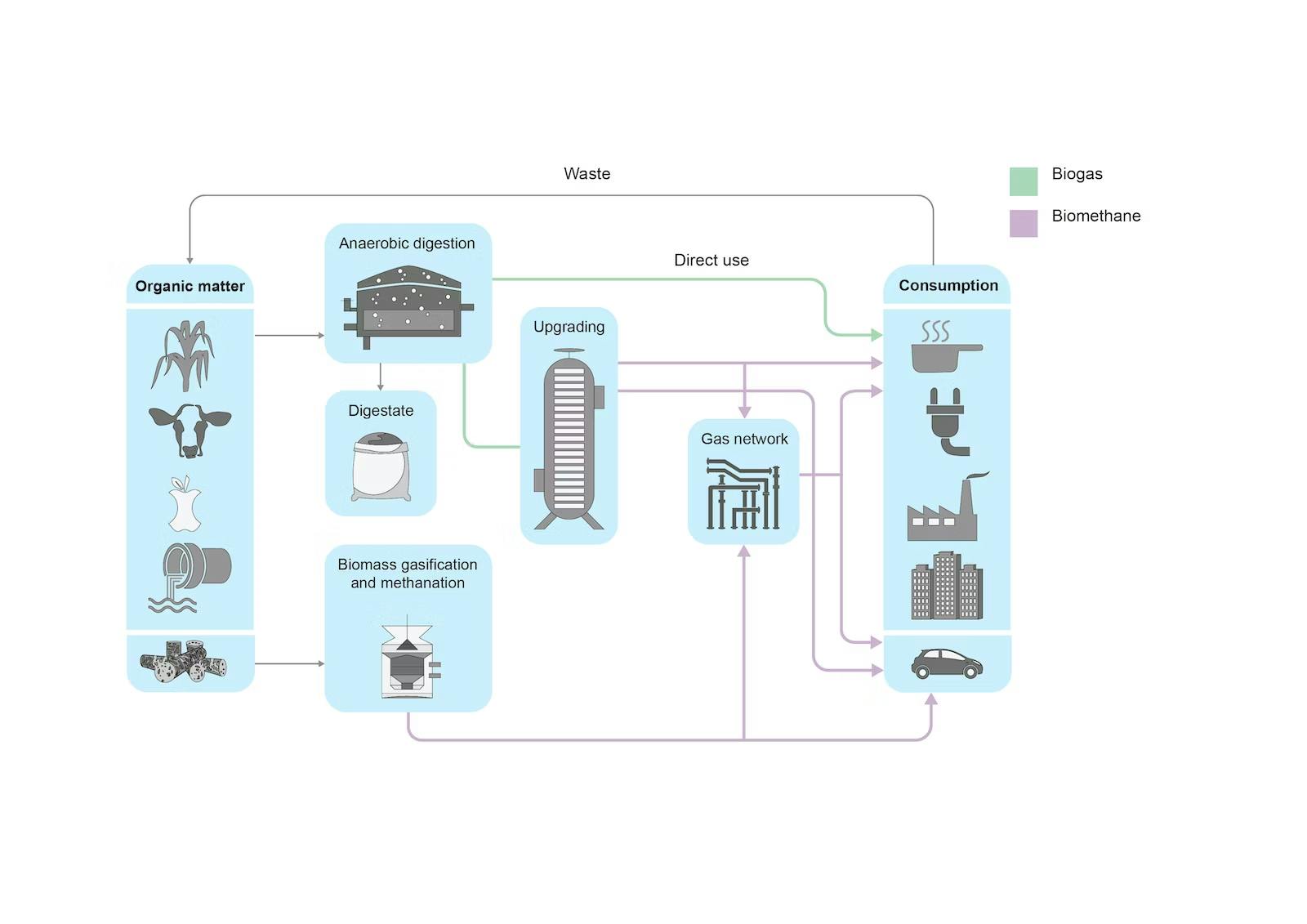

This process consists of letting feed stalk or other waste rot in anaerobic conditions. The sealed chamber used is called an anaerobic digester. After a month or two, this produces “biogas” which is a gas mainly composed of methane and carbon dioxide.

From here, different gases can be used to create renewable energy sources.

- Combined Heat and Power

The syngas and biogas can be burned in a combined heat and power (CHP) unit to simultaneously produce heat and electricity. According to the UK government website on CHP usage, this technique reduces network losses with an efficiency of over 80%. This electricity can be sold to the grid for profit or used locally.

- Biomethane

The other option with biogas is to purify the gas. This is done by removing the carbon dioxide (and other impurities) and converting it to biomethane. This results in a high-quality gas which is comparable to natural gas and can thus be sold into the national gas grid for profit.

Difficulties of Generating Funding for Biomass Energy Projects

Developing a biomass project may require significant upfront investment and ongoing operational costs. This means that the right long-term funding becomes a critical aspect of any project's success. Yet, this is also one of the hardest parts.

Access to a Network

Large developers often have access to a network of investors and lenders whom they can communicate with about their projects. For individuals or smaller/newer developers, they won't have access to these networks. When they are embarking on bioenergy projects, this absence could make the funding process more difficult.

To help facilitate this process and build a network, you can post on a renewable energy project marketplace like PF Nexus. This platform provides accessibility to >5,000 investors and lenders.

Different Types of Biomass Project Funding Options

There are a variety of funding options available for biomass projects, each with its own benefits and challenges. This process can be difficult, but after planning is completed, it is the only thing remaining before the profit from your waste begins to roll in.

Self-financing

For smaller-scale projects, one of the options would be to keep all the development and financing in-house. This option ensures full control over the project, as well as the benefit of keeping all the profit.

Yet, bioenergy projects are often complex and may be difficult to navigate without industry experience. Furthermore, there may be significant upfront costs of installing the needed machinery. This makes this self-financing option less accessible to individuals or businesses.

Creating Initial Revenue Flow

Securing the initial funding required for the project can be difficult, but it is an essential step to success. Early-stage renewable projects are inherently risky. Thus, investors are sometimes hesitant to get involved unless there is an established source of revenue.

If the project produces a physical output such as fuel or gas, this can be sold via an Offtake Agreement. The analogy for a wind farm or other renewable projects would be called a Power Purchase Agreement (PPA). This is when a project produces and sells electricity, the contracted sale of electricity is a PPA.

Offtake Agreements

Offtake Agreements are contracts between the project’s SPV and a purchaser. Common purchasers include a consumer, corporate, broker, utility company or government. Some of the by-products from projects include carbon, biomethane, syngas, or other chemicals. If you are planning to sell a by-product of the project’s function, an offtake agreement may be the key to your project’s success.

The best buyer is considered to be a government body. This is because they tend to have the highest credit rating and hence, the lowest risk of defaulting on the agreement.

Under an Offtake Agreement, the buyer agrees to buy outputs of the project at a pre-defined price for a set length of time (usually 5-25 years). This can provide a stable revenue stream for your project. There are two main benefits to this. Not only help to mitigate some of the financial risk, but also demonstrate stability to potential investors.

This creates low risk in generating revenue. Therefore, the project becomes more attractive to investors and lenders. The result is improved access to cheaper debt agreements from banks or other lenders.

Power Purchase Agreement

PPAs have become the gold standard for renewable projects across most of the world. These operate in broadly the same way as an Offtake Agreement, but are specifically for the sale of electricity.

By contracting the revenue with a counterparty, spot market risk is reduced or removed from the project. Stable and predictable income enables access to lower-cost and higher-leverage debt facilities.

Equity Financing

Equity financing is the most simple option for funding your project. However, this simple option comes with a high cost of capital for equity. It thereby makes sense to prioritise debt and use equity financing only to fund remaining capital shortfalls.

Raising equity is typically done by issuing additional shares in the SPV, in exchange for capital.

There is no traditional repayment with this funding option - instead, the investor owns shares. Investors then make a profit from dividends and/or an exit via eventually selling their stake in the project.

The potential profit creates an incentive for investors to take on the higher risks. This dramatically helps those earlier-stage projects with associated risks.

Debt Financing

Debt typically is associated with a lower cost of capital than equity. That's why many developers prefer to use debt to fund the majority of the project. It also allows the owner to maintain control of the project, since raising the majority of capital via debt often allows them to retain equity.

There are drawbacks with this option. The lender has no exposure to project upside and has 100% exposure to project downside. This means if the project fails, the loan may not be repaid and any risks of default are considered very carefully by the lender.

Depending on the balance of risk, a lender may ask for a parent company guarantee, or a pledge relating to other assets. This shifts much of the default risk. Yet, some people or companies may find this rebalancing of risks to be too anxiety-inducing to warrant consideration.

Project Financing

Large bank loans that are necessary for project development can be challenging to secure. Project financing provides an alternative way to get a loan when restricted by your balance sheet. For new individuals or developers to renewable energy business, banks may not be willing to extend credit based on the lack of a history of cash flow.

The beauty of project financing is that the project requiring capital becomes its own legal entity. This separates it from the developer’s company or individual’s assets. The project is converted into a Special Purpose Vehicle (SPV), which becomes liable for the loan. The repayment would also be made from the cash flows of the project. In the case of a bioenergy project, this would result from the operating asset selling energy, gas, or heat. Revenue generated would become the cash flow available for debt service (CFADS).

This is a viable option for developers who do not have the necessary credit history or do not want to be personally liable for the risk of the project.

How to Find Investors, Lenders, and Developers for a Bioenergy Project

Securing funding for a bioenergy business can be a lengthy process. Luckily, there are several avenues you can explore to find potential investors and lenders.

By listing your project on a renewable energy project marketplace, you can save a considerable amount of time. PF Nexus is a market leader in the renewable energy marketplace space. Our asset marketplace has over $4.5bn/25 GW of live deal-flow. The platform has >5,000 users seeking involvement in renewable energy projects from >3,000 companies.

You can simplify the funding process by submitting your project to us. This creates accessibility for large developers and investors to approach you. It can be frustrating to waste time reaching out to uninterested parties. With PF Nexus, you can ensure that the people you are speaking with are interested in your project. We also don’t require exclusivity and have a success fee.

Signing Off

The PF Nexus platform makes it easy to speak with developers, investors, and lenders. This is independent of whether you choose to keep the project in-house or want outside help. To start your project development today, get in touch to find out more!