What Is a Sleeved PPA? And Its Role In An Evolving Energy Landscape

17 Oct 2023

Introduction

This article is the next instalment in our guides to Power Purchase Agreements (PPA) covering the fundamentals of Sleeved PPAs. The proliferation and adoption of renewable energy is making electricity cheaper, more reliable, and above all more sustainable.

In this article, we’ll explain the basics of how PPAs work, what differentiates sleeved PPAs, and how sleeved PPAs support the UK’s energy transition. If you’re interested in procuring a sustainable source of power for below-market rates, sleeved PPAs may be the option for you.

Power Purchase Agreements (PPAs) Explained

Power Purchase Agreements (PPA) are contacts that guarantee the provision of electricity between buyers and sellers. The generators are Independent Power Producers (IPP) or Renewable Energy Projects (REP), while consumers can be corporate entities, governments, or utilities. They come in many forms (such as physical or synthetic/virtual) and vary in how the 3 main players (utility, generator and off-taker) interact.

PPAs are important to the growth of the renewable energy sector as they guarantees long-term income, increase project bankability, and reduce risk. REPs have high upfront costs, and the negotiated terms of the PPA guard it against market price volatility, increasing its ability to borrow from lenders. In a time when green subsidies are fading away, PPAs offer income security.

For a more holistic understanding of PPAs, please see our articles on What is a Power Purchase Agreement, Corporate PPAs, and Virtual PPAs.

Some of the basic forms of PPAs are:

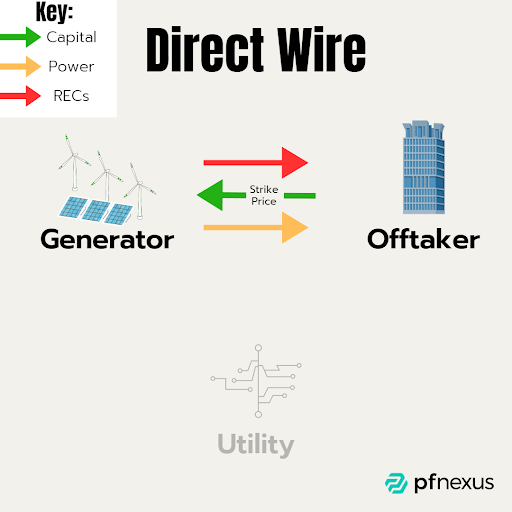

Onsite vs Offsite: One of the first considerations of a PPA is whether the REP will be located onsite or not. Generally, onsite installation carries a greater upfront cost and exposes the consumer to greater risk of intermittent generation, but is cheaper long term due to the minimal distance of transmission. The requirement to have sufficient suitable space, combined with the potentially higher cost of building onsite means most consumers in a PPA will opt to purchase from offsite generators. Direct Wire: Whether onsite or offsite, direct wire PPAs see the direct transmission of power from the generator to the consumer. There are no intermediaries in the agreement, and the generator directly consumes the power generated by the REP. While they carry greater upfront costs and regulatory challenges, they offer greater security against non-energy and network fees.

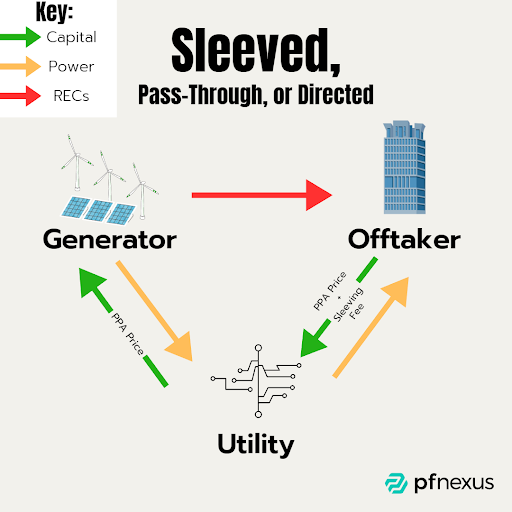

Sleeved: Also known as directed or pass-through PPAs. When consumers with a lower risk/cost tolerance seek to enter PPAs, sleeved PPAs are a viable option because of the simplified structure they offer. Power from the generator is transmitted to a local utility company which transmits power to the consumer while supplementing power when demand exceeds the REP’s generation ability. This process is known as sleeving which we will explain in further detail below.

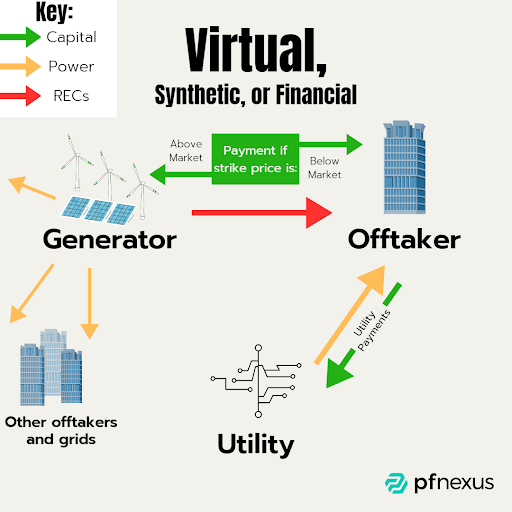

Virtual/Synthetic: Also known as financial PPAs. Virtual PPAs (vPPA) are strictly financial agreements (Contracts for Difference) that act as a hedge against energy price risk in which no power is directly transmitted between the generator and the offtaker. They offer greater flexibility relative to other forms of PPAs but are more complex than other forms of PPAs and have unique regulatory challenges.

The Mechanics of Sleeved PPAs: How do they work?

Three key parties compose a sleeved PPA: the generator, the intermediary (colloquially referred to as “utility”), and the customer. The generator of the REP is responsible for generating the electricity to meet customer demand. The customer offtakes power generated by the REP in exchange for the strike price negotiated in the PPA. The utility is the intermediary responsible for delivering power from the generator to the offtaker in exchange for a sleeving fee they collect from the consumer.

Sleeved PPAs reduce overall costs and simplify management for the customer. Firstly, by transmitting the power generated by REPs to utility companies, the pre-existing infrastructure eliminates the need to install new power transmission infrastructure. Secondly, an accredited intermediary such as a utility company or Independent/Regional Service Operator circumvents many of the regulatory hurdles other PPAs encounter.

The sleeved component of sleeved PPAs is the act of transferring certain rights and obligations from one party in the PPA to another. In sleeved PPAs, the utility assumes roles such as fulfilling the consumer’s demands and collecting payments. Sleeving protects the customer from many of the risks associated with other forms of PPAs:

(1) The utility is the entity that bears the price risk and addresses market fluctuations on behalf of the customer. In the event of high market volatility, the utility is the entity that pays the difference depending on the terms of the PPA. Moreover, they bring expertise in negotiating PPA terms to minimise price risk in the first place.

(2) The utility’s role as the intermediary mitigates the effect of information asymmetry as most customers are unfamiliar with all the regulations and considerations that go into negotiating PPAs. Because the utility manages the regulatory concerns, the customer’s need for specialist advisors is reduced compared to customers looking to enter vPPAs or direct wire PPAs.

(3) If the renewable energy provided by the generator is insufficient to satisfy the customer’s demand, the utility provides the difference as part of the PPA. This ensures continuity of power during sudden peaks or in events of environmental conditions interfering with the predicted output of renewable energy.

Customers who enter sleeved PPAs also in many countries earn Renewable Energy Credits (REC), or a similar/equivalent incentive for purchasing power from renewable energy sources. They not only demonstrate to stakeholders the company’s commitment to sustainability, they are often tradable assets that can earn capital.

*RECs are an industry catchall term - names and terms of use differ depending on jurisdiction.

The Pros and Cons of Sleeved PPAs

With the range of options available for customers looking to enter a PPA, there are several factors to consider in determining if a sleeved PPA is their most viable option.

Some of the main advantages of entering a sleeved PPA are:

- Cost savings: well-negotiated PPAs will be priced below market value and be cheaper for the customer

- Simple structure: compared to other forms of PPAs, sleeved PPAs may be subject to less regulatory requirements and are easier to arrange

- Risk mitigation: the customer’s use of an intermediary shields them from many risks

- Revenue stability: predictable income from the sleeved PPA shields developers from market volatility and finances the project’s long-term success

Some of the main disadvantages of entering a sleeved PPA are:

- Sleeving service fee: customers have to pay a premium to their utility in exchange for simplicity and expertise

- Credit risk: The creditworthiness of multiple parties come into play as all must be financially sound to execute their services

- The complexity of contracting agreements: normally sleeved PPAs have two sets of contracts, one between the customer and generator, and the other between the customer and utility. Negotiating contracts between all three parties can incur greater complexity as opposed to a traditional PPA.

- Limited flexibility: Because the power generated is transmitted to the utility, options for multi-site integration are limited, and not every REP can enter a sleeved PPA

The pros and cons of the sleeved PPA structure can lead to it making it a preferable option relative to other PPAs. Compared to direct wire PPAs, there is no need to install new transmission infrastructure as the intermediaries utilise their pre-existing networks. That reduces the cost of upfront capital and reduces risk in the long term. Sleeved PPAs can be preferred over vPPAs due to their simpler structure and regulatory requirements.

The Role of Sleeved PPAs in the Renewable Energy Sector

As the global energy transition gains momentum, sleeved PPAs will play a crucial role in the energy market. The financial arrangement of sleeved PPAs reduces risk and increases the long-term viability of renewable energy projects.

For consumers, sleeved PPAs reduce costs and simplify administration. That increases the accessibility of renewable energy to a wider range of consumers. Greater accessibility to green energy leads to greater incentives to transition to renewable energy.

For generators, sleeved PPAs minimise risk and provide a consistent source of income. The guaranteed cash flow comes at the expense of potential market profits but increases the ability of the project to borrow in the long term. That gives the capital necessary to see that projects pay off debts and begin to turn profits.

So, sleeved PPAs in conjunction with other forms of PPAs end up creating a form of virtuous cycle. Properly financed projects increase access to renewable energy which in turn finds more customers entering PPAs that raise the capital to finance further renewable energy projects.

A current example demonstrating the importance of sleeved PPAs is Transport for London’s (TfL) tender for a renewable PPA. TfL seeks to procure up to 200GWh to support underground operations using a sleeved PPA structure. The sleeved PPA they seek will protect against future market volatility and progress London’s goal to be net zero by 2030.

Sleeved PPAs in the UK Context

The UK is in a unique position as the Net Zero strategy sets a legally binding target to bring greenhouse gas emissions to net zero by 2050. The Office of Gas and Electricity Markets (Ofgem) set the regulations and price controls that PPAs must abide by and is currently supporting the Net Zero Strategy. But the UK energy market’s conditions are providing incentives independent of regulation.

Corporate PPAs (cPPA) rose to prominence as the prices negotiated in them have consistently beat the market prices of traditionally generated electricity. As of 2020, most of the cPPAs signed took the form of sleeved PPAs. The majority of customers are not capable of managing the offtake and balancing of power for themselves, so the intermediaries of sleeved PPAs assume that role.

Those looking to enter sleeved PPAs are not just limited to corporations with the capital to flex. PPAs are becoming increasingly accessible as demonstrated by a group of 20 UK universities entering an aggregated renewable PPA. The £50m PPA will see its energy generated from wind farms and sleeved through EDF Energy.

Conclusion

The bottom line is that sleeved PPAs create flexibility for customers because using an intermediary to distribute power reduces many of the costs, regulations, and administration associated with power procurement. Existing infrastructure eliminates the need for costly installations of power lines, and using existing utilities circumvent regulatory headaches altogether.

Sleeved PPAs make renewable energy not only a financially prudent choice but also incentivise the transition to green energy. Sleeved PPAs secured their place in the mid-term future as the UK’s Net Zero strategy recognizes the challenge of transitioning away from a carbon-based economy. Engaging in sleeved PPAs will end up not only saving money, but ultimately finance the growth and development of renewable energy.

About PF Nexus

PF Nexus is a platform accelerating the global energy transition by providing a centralised hub for investors, developers, and lenders to come together. Development and finance teams can use our database and project marketplace to explore renewable opportunities and create partnerships.

Subscribers gain full access to an database and marketplace, from which they can see the various renewable energy projects available. Projects such as utility-scale solar, wind, battery, and other sustainable infrastructure are all available to support the creation of a diversified portfolio. From there they can make and evaluate deals, and collaborate with advisors and project owners.

With nearly 5,000 users from over 2,600 clean energy investors, lenders, advisors, and developers, PF Nexus is rapidly gaining traction in the industry, particularly as countries strive towards net-zero emissions, and the energy transition continues to progress.